best canadian stocks to sell covered calls

If you are looking for a decent covered call play Oracle may be a very good choice. In other words if you buy TransAlta Renewables stock today and write a covered call option on it youll generate 027833 per share in income minus any commissions on the.

10 Best Covered Call Etfs In Canada Oct 2022 Limit Your Downside

COP ConocoPhillips operates on a global scale exploring for producing transporting and selling.

. FHI CI Health Care Giant Cover Call ETF The ETF holds the top healthcare stocks from the US which have usually less volatility than. You can also take advantage of the dividend which hovers below 175. Both ETFs are focused on US stocks.

It will give investors exposure to all of the 6 major. Ad The Money Press Method Is Refreshingly Different. Now covered call ETFs in Canada are offering investors yields of 67 to more than 26.

What are some good picks for covered calls these days. BMO Covered Call Canadian Banks ETF TSEZWB The Canadian covered call bank ETF by BMO serves a simple purpose. Going to sell weekly calls and roll premiums into.

Best canadian stocks to sell covered calls. Best canadian stocks to sell covered calls. To have a Canadian covered call ETF in the list the best one is ZWB BMO Covered Call Canadian Banks ETF for consistency and safety.

List of 2022s Best Stocks for Covered Calls ConocoPhillips NYSE. ZWB Is a BMO covered call ETF that sells covered calls against long positions in the major Canadian banks. As its name suggests ZWB holds stock positions in the major.

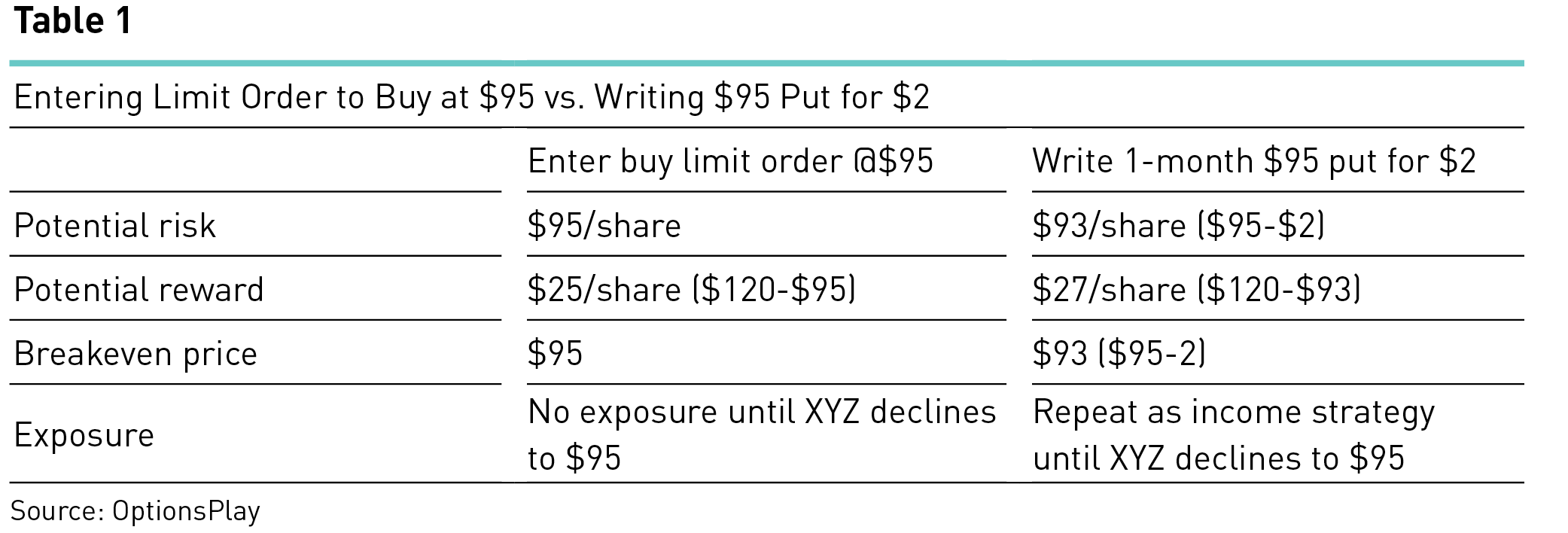

Now to execute a covered call you choose a strike price of 65 at which you sell the call option Contracts and the premium for the selling of the call option is 57 per share. The companys 2022 outlook is optimistic and progressive. Below we have compiled a list of best stocks for covered call strategy which can yield good premiumsprofits during 2022.

The top holdings by weight. Covered calls are a proven way to bring in extra retirement income and mitigate some equity risks. Best stocks for selling covered calls tend to be the ones that stay relatively neutral.

Just sold my first covered call this morning on AAPL 132 Strike 57 exp 40 premium. It is always good to. Best stocks for selling covered calls tend to be the ones that stay relatively neutral.

So if youre looking for the best stock to sell covered calls were glad we could help. I know you hate weed stocks but WEED has been. The best time to sell a covered call is when a stock you own is both.

The premium on puts is higher than on calls for the same risk profile. BMO Covered Call Canadian Banks ETF TSEZWB The Canadian covered call bank ETF by BMO serves a simple purpose. The pink with 173 is NA National.

The return is 270 option premium plus 167. Been running the wheel on TD AC LSPD DOL MFC CTC CRON WEED. Verizon forecasts a 1 percent to 15 percent rise in service and other revenues and a 9 percent to 10 percent.

If youre considering purchasing a Keyword we strongly recommend you look deeper at our top. It will give investors exposure to all of the 6 major. Removed emihic 1 yr.

Deleted 2 yr.

Exit Strategies For Covered Call Writing Making The Most Money When Selling Stock Options Ellman Alan 8601421690027 Amazon Com Books

Best Canadian Stocks For Covered Calls Nbdb

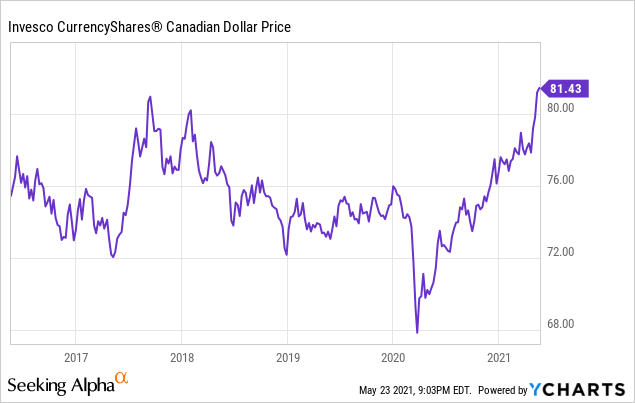

My Top Ten Canadian Monthly Payers Seeking Alpha

3 Retail Stocks To Sell Covered Calls On Nasdaq

10 Best Canadian Stocks To Buy Now Updated October 2022 Finder Canada

10 Best Covered Call Etf Canada High Dividend Yield

How To Write A Covered Call On The Td Ameritrade Mobile App Youtube

The Wheel Strategy Option Matters

Best Covered Call Etfs In Canada 2022 Earn High Yields With Call Options Savvy New Canadians

10 Best Canadian Stocks To Buy Now Updated October 2022 Finder Canada

The Definitive And Practical Guide To Selling Covered Calls Option Matters

Selling Covered Calls Vs Shorting A Stock The Motley Fool

Best Canadian Stocks To Buy 2022 Marketbeat

The Ultimate Options Wheel Strategy Guide Passive Income Generator Johnny Africa

Dow 30 Stocks And Covered Call Writing Implementing The Premium Blue Chip Report The Blue Collar Investor

Selling Covered Calls For Income Vectorvest

Selling Covered Calls For Monthly Income Easily Rick Orford